What Does Profit and Loss Statement Mean?

A profit and loss statement (P&L) is a financial document that summarizes a company’s revenue, cost of doing business, and profit/loss incurred for a certain time period. This statement calculates a company's net income after expenses are deducted from sales. The financial figures provide owners with valuable information about their company's financial health by demonstrating the company's ability to generate revenue and keep expenditures under control. This statement is also a useful tool for forecasting future budgets and avoiding excessive costs.

According to financial experts, the profit and loss statement is one of the most significant financial records for companies to maintain track of their finances. All private limited firms are required by law to keep a profit and loss statement as part of their yearly statutory accounts. A P&L statement can be generated in a variety of methods, including monthly, quarterly, or annual assessments, which can be used to evaluate and compare business performance over time. Other names for Profit and Loss statements are income statements and statements of operations

What is Included in a Profit and Loss Statement?

The statement is broken down into three primary sections i.e revenue, expenses, and equity, and includes the following information.

- The total revenue generated by the business

- The cost of goods sold by the business

- Selling, General & Administrative Expenditures

- Marketing and Advertising expenses

- Salaries, Benefits, Wages paid to employees

- Technology/Research & Development expenditures

- Utility bills paid

- Interest Expenses incurred

- Taxes paid or payable Returns/Discounts

- Rent paid

- Depreciation if any

- Net profit

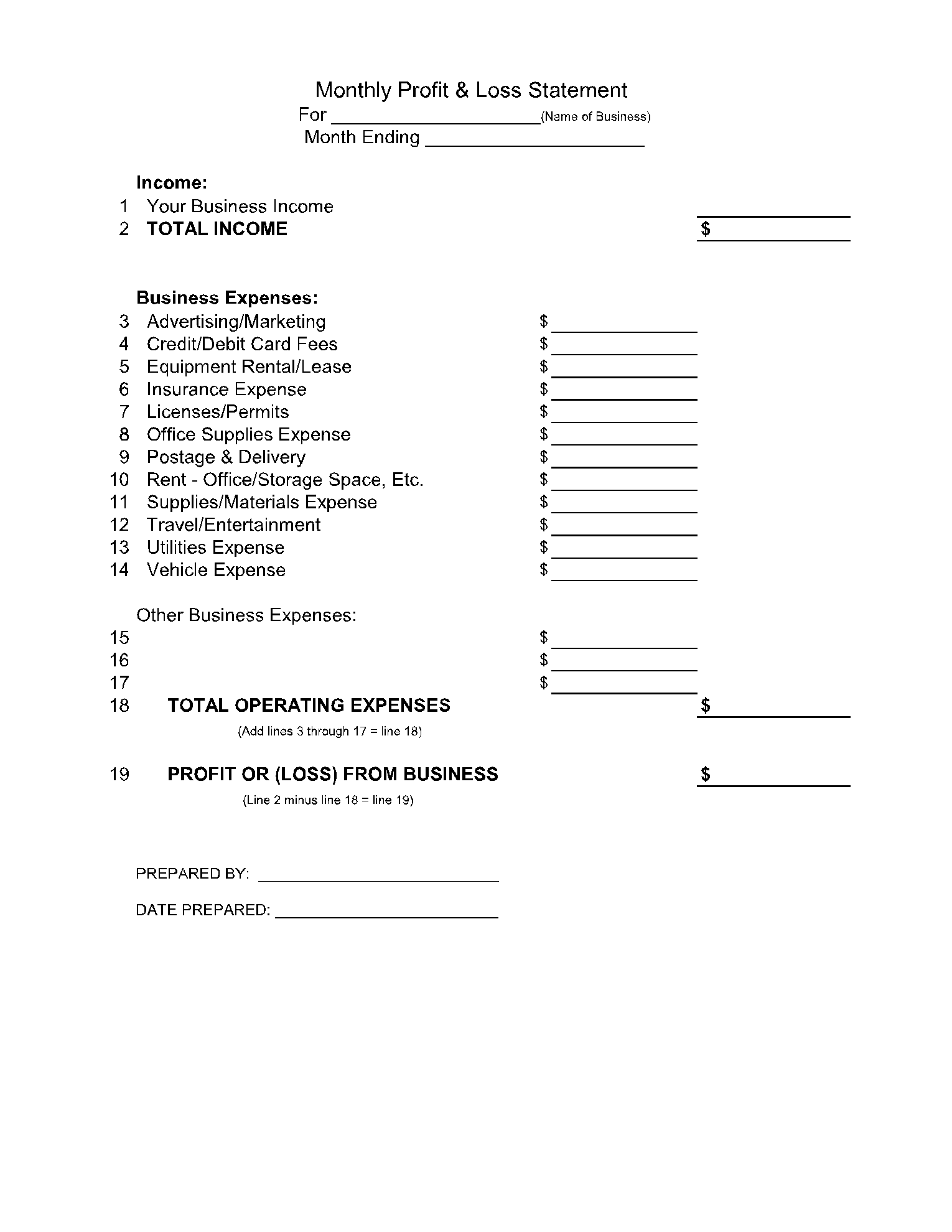

Steps to Follow While Filling Profit and Loss Statement Template

The following steps will help you in filling the sections of the P&L statement template.

Business Income Section

Step 1: Generally, the first line of the P&L statement contains the company/business name. Write your company’s name right after the statement title.

Step 2: Specify the period for your P&L statement in the space following your company’s name. It may be a month, a quarter, or even a year.

Step 3: Note down the total revenue generated by your business in the TOTAL INCOME space given.

Business Expenses Section

Step 4: Write down the expenses for your product marketing/promotion in the first space of the “Business Expenses” section.

Step 5: Note down any fee paid for debit card/credit card.

Step 6: Specify any expenses incurred for equipment rent or lease.

Step 7: Add any insurance expenses you have paid in the specific time period.

Step 8: You can add the expenses paid by your company for any license/permit in the space given for “License/Permits” of the “Business Expenses” section.

Step 9: The “Office Supplies Expenses” space is given for office supplies expenditures incurred to run the day-to-day office work.

Step 10: The expenditures paid on postage or any other delivery can be added here in the “Postage & Delivery” blank space.

Step 11: The ”Rent-Office/Storage Space, Etc” space is for expenditures in respect of office rent or any other building rent paid for running the business.

Step 12: Add the cost of supplies and material purchased for producing goods.

Step 13: You can add any travel or entertainment expenditures accrued by the company in the space given for ”Travel/Entertainment” expenses.

Step 14: Write the amount paid in respect of utility bills i.e electricity, gas, water, etc.

Step 15: This space is for vehicle expenses that can be related to maintenance or any other.

Other Business Expenses Section

Step 16: You can add more operating expenses in the ”Other Business Expenses” given spaces that are not mentioned in the above section. These expenses can be the salaries/wages of the employees, taxes paid, or any other operating expenses charged from the company’s account.

Step 17: Add all the expenses from step 4 to step 16 and write them down in the space given for “Total Operating Expenses”.

Profit or Loss Section

Step 18: Subtract the total expenses in step 17 from step 3 total revenues and write down the figure in the “PROFIT OR (LOSS) FROM BUSINESS” space. That is your total profit for the specific period.

Step 19: Write down your name along with the date in the spaces given next to “Prepared By” and “Date Prepared” respectively.

What are the Common Uses of Profit and Loss Statement?

The following are the most common uses of a P&L statement.

- Profit and loss statements are often prepared at the end of each month, quarter or year. This statement is used to inform you how much profit or loss you're accruing in a specific period.

- Profit and loss statements may be used to create sales goals and suitable pricing for your products or services.

- When you examine your profit and loss accounts over several accounting periods, you can see how operational expenses, revenue, and net profit have changed over time.

- To gain a deeper understanding of your company's finances, there are a number of important financial metrics that are calculated using the P&L statement, including the gross profit margin, net profit margin, and operating margin.

- Investors or lenders use the P&L statement to get information about the amount of money a company brought in and the amount of money spent up to that point. This enables them to determine if the firm is successful and to forecast future growth based on the organization's historical growth rate.